The answer is: Yes, sometimes.

If you don’t have significant income in retirement besides Social Security benefits, then you probably won’t owe taxes on your benefits. But if you have large amounts saved up in tax-deferred vehicles like 401(k)s, you could be in for a surprise later.

AGI (Adjusted Gross Income) versus Combined Income.

You are probably familiar with what AGI, or adjusted gross income, means. To find it, you take your gross income from wages, self-employed earnings, interest, dividends, required minimum distributions from qualified retirement accounts and other taxable income, like unearned income, that must be reported on tax returns.

(Unearned, taxable income can include canceled debts, alimony payments, child support, government benefits such as unemployment benefits and disability payments, strike benefits, lottery payments, and earnings generated from appreciated assets that have been sold or capitalized during the year.)

From your gross income amount, you make adjustments, subtracting amounts such as qualified student loan interest paid, charitable contributions, or any other allowable deduction. That leaves you with your adjusted gross income, which is used to determine limitations on a number of tax issues, including Social Security.

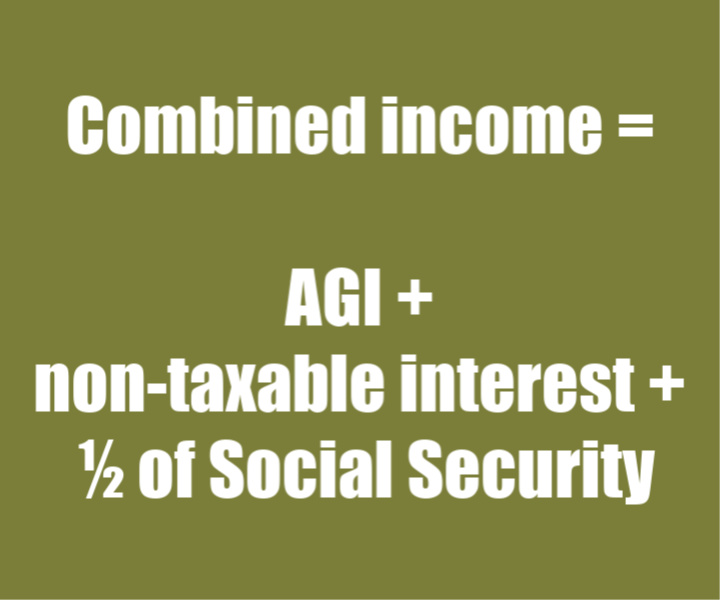

Combined Income is a formula used after you file for your Social Security benefits.

Whether or not your Social Security benefits are taxable depends on your combined income each year, which is defined as your adjusted gross income (AGI) plus your tax-exempt interest income (like municipal bonds) plus one-half of your Social Security benefits.

The IRS provides a worksheet for this. (See the worksheet here: https://www.irs.gov/pub/irs-pdf/p915.pdf#page=16)

If your combined income exceeds the limit, then up to 85% of your benefit may be taxable. But in accordance with Internal Revenue Service (IRS) rules, you won’t pay federal income tax on any more than 85% of your Social Security benefits.

What are the combined income limits?

Social Security benefits are only taxable when your overall combined income exceeds $25,000 for single filers or $32,000 for couples filing joint tax returns.

If you file a federal tax return as an “individual” and your combined income is:

- Between $25,000 and $34,000 – you may have to pay income tax on up to 50% of your benefits.

- More than $34,000 – up to 85% of your benefits may be taxable.

If you file a “joint” return, and you and your spouse have a combined income that is:

- Between $32,000 and $44,000 – you may have to pay income tax on up to 50% of your benefits.

- More than $44,000 – up to 85% of your benefits may be taxable.

RMDs (Required Minimum Distributions) can be an unwelcome surprise.

Starting at age 70-1/2, you are required to start taking money out of your tax-deferred accounts, whether you need the income or not. These accounts include:

- Traditional IRAs

- SEP IRAs

- SIMPLE IRAs

- Rollover IRAs

- Most 401(k) and 403(b) plans

- Most small business retirement accounts

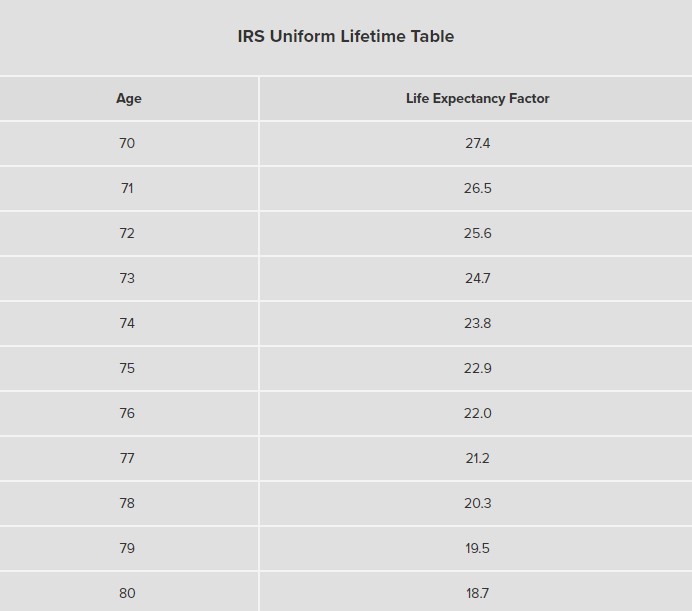

There are precise formulas for calculating how much you have to withdraw each year based on the IRS Uniform Lifetime Table. If you miscalculate, or if you or your plan administrator fail to move the money by December 31, you could face a 50% tax penalty; there is no grace period to April 15.

NOTE: The table goes up to age 115 and beyond. You can find the IRS life expectancy table as well as an IRS worksheet for calculating RMDs here: https://www.irs.gov/pub/irs-tege/uniform_rmd_wksht.pdf

Simplified RMD example for illustrative purposes only:*

Let’s say you are single, age 72, and you have one qualified account—$400,000 was the value of your 401(k) plan as of December 31 last year. You divide $400,000 by your life expectancy factor of 25.6 which give you $15,625.

This is the amount that you have to take out of your 401(k), which will count as part of your AGI.

Simplified Combined Income example for illustrative purposes only:*

To continue with our simplified example, let’s say you, our 72-year-old single person above, receives $2,800 per month in Social Security ($33,600 per year) and you don’t have any other source of income besides the RMD taken from your 401(k) account as illustrated above.

Based on the combined income formula:

AGI = $15,625

+ Non-taxable interest = $0

+ Half of Social Security = $16,800

__________________________________________

Your total combined income is = $32,425

Because you are over the combined income limit of $25,000 for an individual, but less than the $34,000 which would require 85%, you would pay taxes on 50% of your Social Security benefit.

###

At Bulwark Capital Management, we provide retirement planning and Social Security benefit optimization, and we work in conjunction with your CPA or tax professional to help you consider taxes and how to minimize them as part of your overall retirement plan. Call us at

253.509.0395.

* This material is not intended to be used, nor can it be used by any taxpayer, for the purpose of avoiding U.S. federal, state or local taxes or penalties. The information in this article is provided for general education purposes only. Do not rely on this information for tax advice. Check with your CPA, attorney or qualified tax advisor for precise information about your specific situation.

Sources:

https://www.investopedia.com/terms/t/taxableincome.asp

253.799.6416

253.799.6416 invest@bulwarkcapitalmgmt.com

invest@bulwarkcapitalmgmt.com