World events can impact your retirement, but you can be prepared!

The past few years have shown us that big world events can impact our lives at any moment. Sometimes we see them coming. Other times, we don’t have the ability to prepare and buckle in for the turmoil ahead.

The COVID-19 virus is one of the best recent examples of major world events impacting the economy. Now, the Russian invasion of Ukraine appears to be taking an immediate toll on Americans financially. It begs the question, can we prepare for these types of events so that we can, at least, soften the blow to our futures?

Well, the first step toward answering that question is knowing what to look out for when these major moments strike. Here are five ways big world events can impact your retirement:

- Market Shifts

Reactions to global events often shift the market, and in times of crisis, that shift is typically negative [ An article from ThinkAdvisor said a global recession because of a negative supply shock is now “highly likely,” especially when you tack on the fact that the world is still recovering from the spread of the COVID-19 virus[1].

Market downturns often hurt retirees, especially if they have to withdraw money from accounts like mutual funds, stocks or bond funds for retirement income while account values are down. For those in or approaching retirement, the situation can be difficult if they have no other sources of income and have to keep taking money out of dropping accounts, especially at the beginning of their retirement (known as “sequence of returns risk”). In fact, many people on their way into retirement during the Great Recession were forced to remain in the workforce when they lost everything[

It’s also worth noting that market crashes can actually help younger investors because they have a long time-horizon to retirement and can “buy and hold” bargains. In other words, if younger people are able to invest when the market bottoms out, it might be an opportunity to buy low in order to accrue higher long-term gains.

- Inflation

Inflation can have a profound impact on finances, and those taking the brunt of the blow might be the ones who are no longer stockpiling resources. Inflation isn’t a new concept, but when your retirement money doesn’t go as far as you hoped, it can put your plans for your golden years in jeopardy. Over the course of the pandemic, the United States sent stimulus checks to qualifying Americans three different times. With more money in the pockets of consumers, prices rose, and they didn’t fall after people spent their stimulus checks. In fact, they continued to rocket upward. The Washington Post reported that inflation reached 40-year highs at the time of Russia’s invasion, posing major questions for the U.S., the Federal Reserve and retirees stretching their financial resources to their limits[4].

- Gas Prices

This one is no secret. In fact, if you drive past a gas pump when supply is short, your jaw might drop. As the Russian invasion of Ukraine wages on, CNN reports the biggest jump in gas prices since Hurricane Katrina[8]. Russia is not the only supplier of oil, but it is Europe’s largest, producing 10% of the global demand. The U.S. imports just 8% of its oil from Russia, but energy is a global commodity, meaning that a rise in one part of the world causes a rise in another part of the world[10]. Bob Doll, the chief investment officer of Crossmark Global Investments, spoke to ThinkAdvisor to discuss the effects of the Russia-Ukraine war. He noted, several times, that oil prices can devastate the economy. He said the price surge is why the war should be investors’ chief concern in 2022. Doll went on to say that inflation is likely still yet to peak because of rising oil prices[2].

You might be wondering what that has to do with your retirement. The spike in oil costs and inflation drastically affect the purchasing power of a dollar, which could be most impactful to those living on fixed incomes. If you’re in retirement, it could force you to spend more at the pump, taking away from valuable dollars you may need for other expenses.

- Shifting of Retirement Ages and Plans

Uncertainty in markets, inflation and other results of a global crisis can also upset retirement plans decades in the making. In 2021, CNBC reported that 35% of Americans changed their retirement plans because of the pandemic[6]. 68.5% of those who changed their plans said they moved their retirement expectations back by up to 10 years. Some did report that they planned to move retirement up, but the uncertainty forced others on the brink of finishing their careers to table their hopes and remain in the workforce to continue collecting paychecks.

- General Panic

Major events, especially ones that have negative impacts on people, markets and finances, can cause panic. Common wisdom says to never make decisions in a panicked state, but it is easy to see how you might want to unload certain investments or liquidate assets out of fear that things might get worse. In his ThinkAdvisor feature, Bob Doll said advisors shouldn’t be recommending any major risks right now, arguing that investors have seen the market during wartime, and it typically bounces back[2]. Oftentimes, approaching the situation from a more measured perspective could actually provide an opportunity. A Kiplinger article used The Great Recession as a teacher for retirees in a crisis, citing one investor who remained patient, even adding to his investments as stock prices hit the basement[9]. He later said he was headed toward an early retirement and squashed his fear of volatility. With a calm, steady approach, retirees can take steps to fight market downturns.

If you have questions about how you can protect your retirement plans and weather global economic storms, please give us a call. You can reach Bulwark Capital Management at 253.509.0395.

Sources:

- https://www.thinkadvisor.com/2022/02/25/roubini-6-financial-economic-risks-of-russia-ukraine-war/

- https://www.thinkadvisor.com/2022/03/07/bob-doll-10-talking-points-for-advisors-investors-amid-russia-ukraine-war/

- https://www.nytimes.com/2022/02/23/business/economy/russia-ukraine-global-us-economy.html

- https://www.washingtonpost.com/us-policy/2022/03/02/powell-testimony-inflation-fed/

- https://finance.yahoo.com/news/russia-ukraine-crisis-what-can-prevent-150-oil-prices-112747924.html

- https://www.cnbc.com/2021/10/12/pandemic-has-disrupted-retirement-plans-for-35percent-of-americans-study-says.html

- https://www.aljazeera.com/news/2022/3/3/how-much-oil-does-the-us-import-from-russia

- https://www.cnn.com/2022/03/04/energy/gas-prices/index.html

- https://www.kiplinger.com/slideshow/retirement/t047-s004-5-retirement-lessons-learned-from-great-recession/index.html

- https://www.eia.gov/dnav/pet/pet_move_impcus_a2_nus_ep00_im0_mbbl_a.htm

- https://www.diva-portal.org/smash/get/diva2:727314/FULLTEXT01.pdf

- https://money.usnews.com/money/retirement/articles/2011/10/31/the-recessions-impact-on-baby-boomer-retirement

Investment Advisory Services offered through Trek Financial LLC., an (SEC) Registered Investment Advisor. Information presented is for educational purposes only. It should not be considered specific investment advice, does not take into consideration your specific situation, and does not intend to make an offer or solicitation for the sale or purchase of any securities or investment strategies. Investments involve risk and are not guaranteed, and past performance is no guarantee of future results. For specific tax advice on any strategy, consult with a qualified tax professional before implementing any strategy discussed herein. Trek268

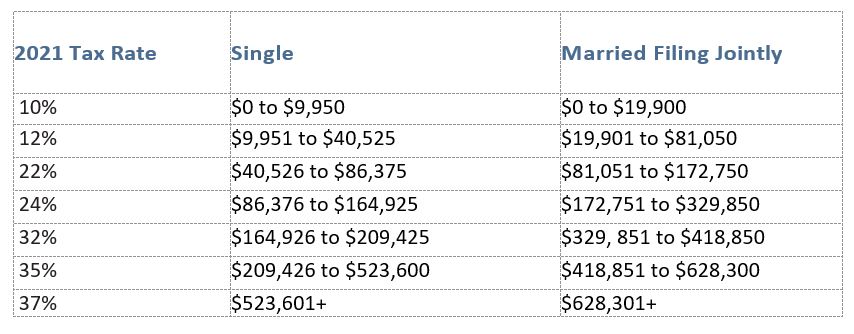

NOTE: These tax rates are scheduled to expire in 2025 unless Congress acts to make them permanent [9].

NOTE: These tax rates are scheduled to expire in 2025 unless Congress acts to make them permanent [9].

253.799.6416

253.799.6416 invest@bulwarkcapitalmgmt.com

invest@bulwarkcapitalmgmt.com