The COLA on Social Security is projected to increase benefits by more than 10%. How does that affect your retirement?

Inflation in the United States is at a 40-year high, and the entire country seems to be feeling the squeeze of rising prices, regardless of income level. Though the debate over the cause of current inflation rates rages on, one thing seems to be certain: the cost of everyday goods, like rent, gas and food, continues to rise [1].

Understandably, that leaves American consumers with questions and concerns. First, as the value of the dollar decreases, which lifestyle adjustments can be made to compensate for the loss in buying power? Second, won’t somebody do something?

This year, the Federal Reserve has taken action by raising interest rates several times in an effort to curb spending and cut demand, ideally forcing the price of goods down, or at the very least, leading them to stagnate [2]. But lately, the Fed has been criticized by experts worried that their actions may not be having the desired effect, but instead may be bringing on a recession [3].

So, what other actions does the government take to protect people from inflation? For retirees and those collecting Social Security benefits, the Social Security Administration began implementing an annual COLA almost five decades ago.

What is a COLA?

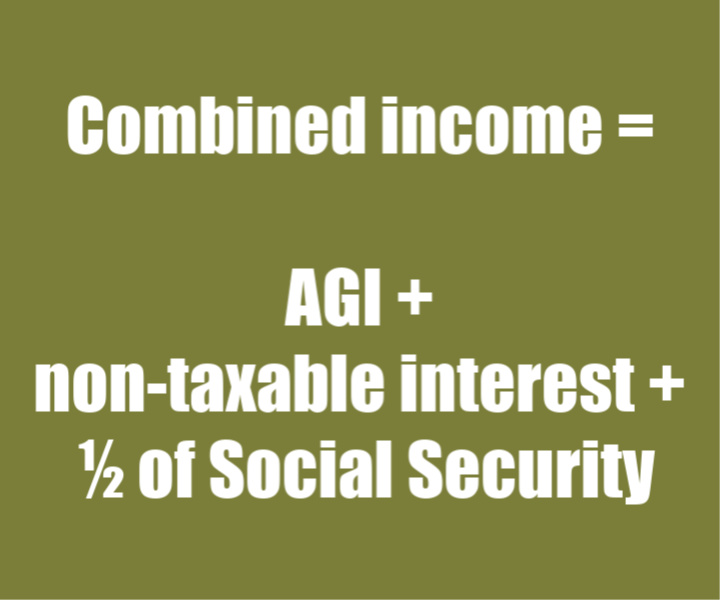

No, it’s not the tasty drink you order when you first sit down at a restaurant. COLA stands for “cost-of-living adjustment” and was first introduced by the Social Security Administration in 1975 in an effort to counter inflation for beneficiaries relying on those funds [4]. Beneficiaries of Social Security, which include individuals who have reached the age of 62 or have qualifying disabilities, can receive an increase in their benefit based on the Department of Labor’s Consumer Price Index for Urban Wage Earners and Clerical Workers, or the CPI-W.

For example, at the beginning of this year, Social Security beneficiaries may have noticed their checks increasing by 5.9%. That increase didn’t happen by chance or because of a missed decimal point in the accounting department. It was a carefully constructed adjustment based on 2021’s inflation rate, ideally giving those living on fixed income a chance against rising costs.

And next year’s COLA for 2023 could be the highest we’ve seen since 1981.

How does this affect retirees?

Retiring isn’t easy, and there’s a reason workers open IRAs and employer-sponsored retirement accounts, like 401(k)s, early in their careers to begin building for the future. Retirement comes with a great deal of financial risk, and one of the biggest contributors to that risk is inflation.

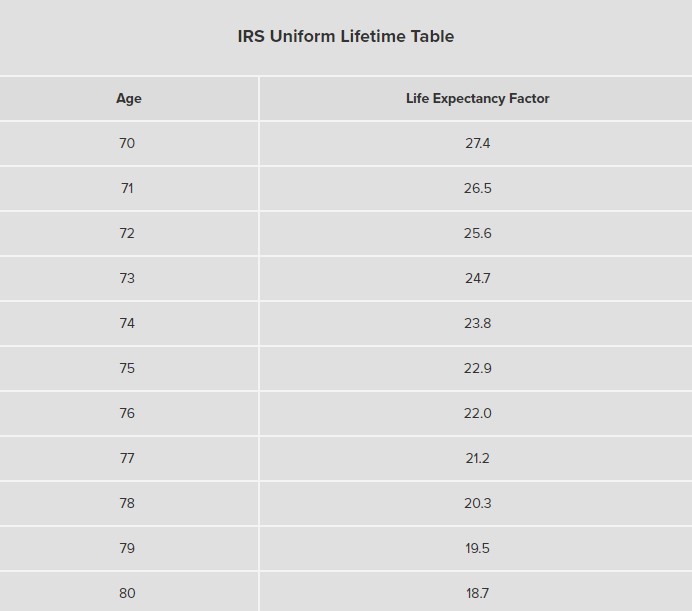

Retirees often live on fixed incomes, withdrawing money from savings accounts, retirement accounts, pensions, annuities, investments and Social Security to cover their living expenses. Though a proper financial plan accounts for inflation, it can be difficult to foresee spikes like the one in 2022, potentially upsetting expectations of how long your money will last. Though imperfect, the COLA can offer retirees increases to one of their main sources of income in retirement, hopefully offsetting change that can occur over the course of decades.

What is the next COLA expected to be, and when can I expect it?

A recent COLA projection made headlines with an eye-popping number. The Senior Citizens League estimates that Social Security beneficiaries could see a 10.5% COLA, meaning that the average monthly benefit could increase by about $175[5].

That estimate has steadily climbed over the past few months, though it’s certainly not yet set in stone. The Social Security Administration will announce the next COLA in October, and it will go into effect in January of 2023.

Are there any problems with COLA?

Though an increase in your Social Security check might sound entirely positive, there are drawbacks to COLA and the problems it aims to correct. The COLA is intended to cover the difference between the current cost of living and the previous year’s cost of living, but it is possible that the extra money in your benefit will only partly cover your increased living expenses.

The COLA is not directly aligned with inflation, so it is possible for inflation to rise faster than Social Security’s adjustment. For example, in 2021, inflation climbed 7% [6] while the COLA only increased by 5.9% [7]. Similarly, the Social Security COLA can remain unchanged year over year, just as it did following 2009, 2010 and 2015 when inflation rose 2.7%, 1.5% and 0.7%, respectively [8].

While not completely reflective of each other, the COLA and inflation do correlate, and inflation is currently outpacing wages. In fact, in 2021, wages actually saw a 3.5% drop when living costs are accounted for [9]. Though this doesn’t directly affect Social Security beneficiaries, the Social Security trust funds are built by contributions from income taxes [10]. It stands to reason that inflation’s outpacing of wages would mean that the Social Security trust funds, which currently project to only be able to pay at their current rate until 2035, would deplete even quicker [11].

So, as someone who collects Social Security or hopes to in the future, what can I do?

First and foremost, we would always recommend speaking with your financial professional to assemble a proper plan for your retirement. The right financial plan can be the difference between having adequate funds for your desired lifestyle or running out of money. Social Security is only one income stream, and backup plans with alternative sources of funds are vital.

If you have any questions about your Social Security benefit, please give us a call! You can reach Bulwark Capital Management at 253.509.0395.

Sources:

- https://www.marketwatch.com/story/coming-up-consumer-price-index-for-may-11654862886

- https://www.forbes.com/advisor/investing/another-75-point-fed-rate-increase/

- https://www.forbes.com/sites/jonathanponciano/2022/07/27/fed-raises-interest-rates-by-75-basis-points-again-as-investors-brace-for-recession/

- https://www.ssa.gov/oact/cola/colasummary.html

- https://www.cnbc.com/2022/07/13/social-security-cost-of-living-adjustment-could-be-10point5percent-in-2023.html

- https://www.cnbc.com/2022/01/12/cpi-december-2021-.html

- https://www.ssa.gov/oact/cola/colaseries.html

- https://www.thebalance.com/u-s-inflation-rate-history-by-year-and-forecast-3306093

- https://www.cnn.com/2022/07/29/economy/worker-wages-inflation/index.html

- https://www.ssa.gov/news/press/factsheets/WhatAreTheTrust.htm

- https://www.thestreet.com/investing/social-security-2035

Investment Advisory Services offered through Trek Financial LLC., an (SEC) Registered Investment Advisor.

Information presented is for educational purposes only. It should not be considered specific investment advice, does not take into consideration your specific situation, and does not intend to make an offer or solicitation for the sale or purchase of any securities or investment strategies. Investments involve risk and are not guaranteed, and past performance is no guarantee of future results. For specific tax advice on any strategy, consult with a qualified tax professional before implementing any strategy discussed herein. Trek 348

253.799.6416

253.799.6416 invest@bulwarkcapitalmgmt.com

invest@bulwarkcapitalmgmt.com