Heads up! If you plan to retire this year, you should know these five things.

Are you planning to enter the most exciting phase of your life in 2024? A phase where you get to do what you want to do, not what you have to do? With the right planning and preparation, it’s possible, but you should be aware of the year-over-year changes that occur for retirees, especially if this is your first year. Here are five changes you should know about if you plan on entering retirement in 2024.

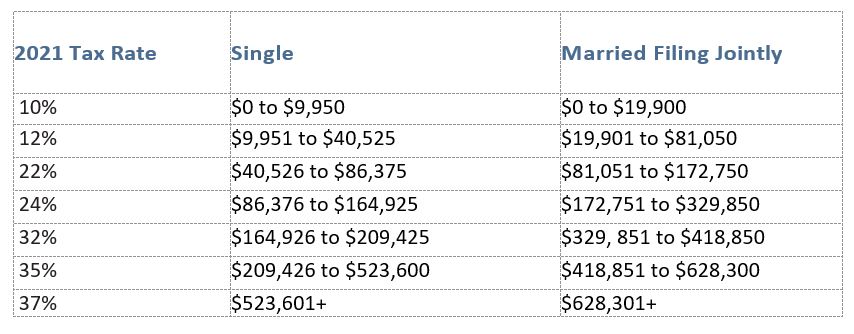

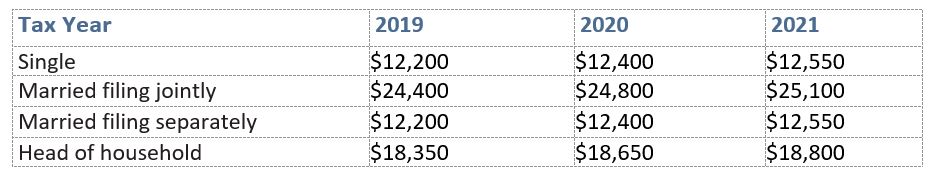

- Higher Income Tax Brackets [1,2]

Traditionally, tax brackets rise with inflation on an annual basis, and 2024 is no different. For instance, the top end of the 0% capital gains bracket is up from $44,625 to $47,025 for single filers and from $89,250 to $94,050 for those who are married and filing jointly. Retirees who expect to withdraw from accounts subject to income tax—like traditional 401(k)s—may also expect to see a bit more relief this year in their income. See below for 2024’s ordinary income tax brackets.

| Rate (%) | Filing Single | Married Filing Jointly | Married Filing Separately | Head of Household |

| 10% | $0 to

$11,600 |

$0 to

$23,200 |

$0 to

$11,600 |

$0 to

$16,550 |

| 12% | $11,601 to $47150 | $23,201 to $94,300 | $11,601 to $47,150 | $16,551 to $63,100 |

| 22% | $47,151 to $100,525 | $94,301 to $201,050 | $47,151 to $100,525 | $63,101 to $100,500 |

| 24% | $100,526 to $191,950 | $201,051 to $383,900 | $100,526 to $191,950 | $100,501 to $191,950 |

| 32% | $191,951 to $243,725 | $383,901 to $487,450 | $191,951 to $243,725 | $191,951 to $243,700 |

| 35% | $243,726 to $609,350 | $487,451 to $731,200 | $243,726 to $365,600 | $243,701 to $609,350 |

| 37% | $609,351 or

more |

$731,201 or

more |

$365,601 or

more |

$609,351 or

more |

- Higher RMD Ages [3]

As of Jan. 1, 2023, retirees must begin taking required minimum distributions at age 73 unless they’ve already started. This was part of a gradual change made by SECURE Act 2.0 that will again raise the RMD age to 75 in 2033. This change can offer more flexibility to retirees who don’t need the money from their qualified accounts and otherwise would have incurred unnecessary income taxes. It also gives them an extra year to find other sources of income or to convert those funds to tax-free money. If you are turning 73 in 2024, your first year required minimum distribution from your qualifying accounts must be withdrawn by Apr. 1, 2025. In subsequent years, they must be withdrawn by the end of the year, or you may incur a 25% excise tax, which may be dropped to 10% if corrected in a timely manner.

- Elimination of RMDs for Roth 401(k)s [4]

One of the perks of the Roth IRA is that it does not come with required minimum distributions because you purchase them with already-taxed money. Roth 401(k) accounts through your employer were the same—except for the employer matching part. Before the passage of the SECURE 2.0 legislation, if your employer offered matching contributions and you chose a Roth 401(k) instead of a traditional 401(k) account, employer matching funds had to be placed into an entirely separate pre-tax traditional account which was taxable. Then, upon reaching RMD age, withdrawals were mandated for both accounts, even though taxes were only due on the matching portion.

Now, as of the passage of the SECURE 2.0 legislation, employers at their discretion can offer their matching amounts on an after-tax basis into Roth 401(k)s or Roth 403(b)s. If your employer offers this option and you choose it, you will owe income taxes on the employer match portion in the year you receive the money, but RMDs will no longer be due.

- Preparation for 2026 Tax Cut Sunsets [5]

Though tax cuts sunsetting at the end of 2025 won’t immediately impact 2024 retirees now, it may be crucial to begin preparing for the 2026 tax year. While the federal estate and gift tax exemption amount is currently $13.61 million per individual, it’s expected to drop back down to below $7 million in 2026. For those with larger estates, that could slice the amount of tax-free money going to beneficiaries in half. Income tax rates could also revert to what they were prior to 2018, meaning that it may be helpful to convert taxable income to tax-free income—for instance, by using Roth conversions—in the next two years. Additionally, those impacted by this change could also look to work with a financial professional to implement long-term tax strategies that give them the opportunity to pass their wealth to their beneficiaries as efficiently as possible.

- Higher Medicare Costs but Increased Social Security Payments [6,7]

Medicare costs are also up in 2024. Though Part A is free to beneficiaries, it does come with an annual deductible, which is up $32 from $1,600 to $1,632. Medicare Part B premiums are also up in 2024 from $164.90 to $174.40, an increase of roughly 6%. It’s important to know that those premiums are traditionally deducted from Social Security payments, which typically also rises with a cost-of-living adjustment determined by the Consumer Price Index for Urban Wage Earners and Clerical Workers, or the CPI-W. In 2024, that increase is 3.2%, so while the adjusted checks won’t be entirely proportionate to the higher Part B premiums, the COLA may help to offset the extra costs.

To learn more about what it takes to prepare for the next stage of your life, call us! You can reach Bulwark Capital Management in Tacoma, Washington at 253.509.0395.

Sources:

- https://www.nerdwallet.com/article/taxes/federal-income-tax-brackets

- https://www.bankrate.com/investing/long-term-capital-gains-tax/

- https://www.milliman.com/en/insight/required-minimum-distributions-secure-2

- https://smartasset.com/retirement/how-roth-401k-matching-works-with-your-employer

- https://www.thinkadvisor.com/2022/12/07/the-estate-and-gift-tax-exclusion-shrinks-in-2026-whats-an-advisor-to-do/

- https://www.cms.gov/newsroom/fact-sheets/2024-medicare-parts-b-premiums-and-deductibles

- https://www.ssa.gov/cola/

Trek 24 – 115

NOTE: These tax rates are scheduled to expire in 2025 unless Congress acts to make them permanent [9].

NOTE: These tax rates are scheduled to expire in 2025 unless Congress acts to make them permanent [9].

253.799.6416

253.799.6416 invest@bulwarkcapitalmgmt.com

invest@bulwarkcapitalmgmt.com